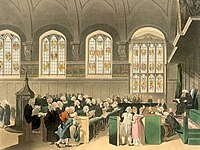

Photo from wikipedia

I study the extent of secure property rights a planner can implement. Agents can produce output, appropriate others’ output, or work in property rights enforcement. The planner pays enforcement personnel… Click to show full abstract

I study the extent of secure property rights a planner can implement. Agents can produce output, appropriate others’ output, or work in property rights enforcement. The planner pays enforcement personnel using taxes collected from producers who can hide income from taxation at a cost. The planner implements perfectly secure property rights by incentivizing production through redistributive taxation and absorbing potential appropriators as enforcement personnel. Both taxation and employment in enforcement institutionalize redistribution that would otherwise take place through appropriation. Higher costs of hiding income permit more redistributive taxation and less enforcement, leading to more production and higher welfare.

Journal Title: Economic Theory

Year Published: 2018

Link to full text (if available)

Share on Social Media: Sign Up to like & get

recommendations!