Photo from wikipedia

Abstract To provide a strong price signal for greenhouse gas emissions abatement, Europe decided to strengthen the European Union Emissions Trading System (EU ETS) by implementing a market stability reserve… Click to show full abstract

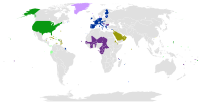

Abstract To provide a strong price signal for greenhouse gas emissions abatement, Europe decided to strengthen the European Union Emissions Trading System (EU ETS) by implementing a market stability reserve (MSR) that includes a cancellation policy and to increase the linear reduction factor from 1.74% to 2.2% after 2020. Results of a detailed long-term investment model, formulated as a large-scale mixed complementary problem, show that this strengthened EU ETS may quadruple EUA prices and may decrease cumulative CO2 emissions with 21.3 GtCO2 compared to the cumulative cap before the strengthening (52.2 GtCO2). Around 40% of this decrease (8.3 GtCO2) is due to the increased linear reduction factor and 60% due to the cancellation policy (13 GtCO2). Without the increased linear reduction factor, the MSR's cancellation policy would decrease emissions by only 4.1 GtCO2, indicating their complementarity. A sensitivity analysis on key model assumptions and parameters reveals that the impact of the MSR is, however, strongly dependent on other policies (e.g., renewable energy targets, nuclear, lignite and coal phase-outs) and cost evolutions of abatement options (e.g., investment cost reductions for wind and solar power). This renders the effective CO2 emissions cap highly uncertain. In our simulation results, cancellation volumes range between 5.6 and 17.8 GtCO2, which is to be compared with our central estimate of 13 GtCO2. We calculate the required linear reduction factors to achieve these CO2 emission reductions without an MSR, which would remove all uncertainty on the cumulative CO2 emissions and interference with other complementary climate or energy policies.

Journal Title: Energy Economics

Year Published: 2020

Link to full text (if available)

Share on Social Media: Sign Up to like & get

recommendations!