Photo from wikipedia

Abstract This article investigates the volatility connectedness of the Eurozone banking system over the last 15 years (from 2005 to 2020). Applying the Diebold-Yilmaz Connectedness Index model to the daily… Click to show full abstract

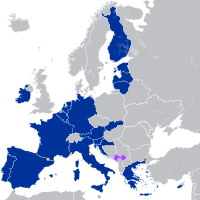

Abstract This article investigates the volatility connectedness of the Eurozone banking system over the last 15 years (from 2005 to 2020). Applying the Diebold-Yilmaz Connectedness Index model to the daily stock return volatilities of 30 major Eurozone banks, we are able to measure the risk spillover effects and to capture the COVID-19 outbreak's impact on banking stability. The empirical findings show that the 30 banks are highly interconnected. Furthermore, we show the strong impact of the COVID-19 pandemic on the volatility dynamics, i.e., on the structure of the Eurozone banking system. Dynamically, we find that volatility connectedness increases during crises, reaching its maximum peak at the time of COVID-19. The analysis points out the critical role of volatility transmission played by large banks, highlighting the “too-big-to-fail” characteristic of this banking system. However, we find that small-medium banks are important actors of contagion, supporting the thesis that the Eurozone banking system is also “too-interconnected to fail.” Finally, we document the heterogeneity effect of the COVID-19 pandemic between Eurozone banking systems. This heterogeneity impact could be a future source of financial instability within the Eurozone.

Journal Title: Global Finance Journal

Year Published: 2021

Link to full text (if available)

Share on Social Media: Sign Up to like & get

recommendations!