Photo from wikipedia

Abstract Part of a prediction is the judgment applied by the forecaster. This judgmental input may be affected by the forecaster’s mood swings, which have been shown to affect, for… Click to show full abstract

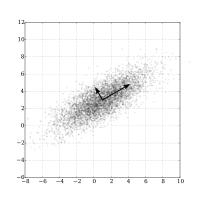

Abstract Part of a prediction is the judgment applied by the forecaster. This judgmental input may be affected by the forecaster’s mood swings, which have been shown to affect, for example, stock market returns. The present paper analyzes the extent to which mood (approximated by the development in sentiment indicators) affects macroeconomic prediction errors; i.e., whether it explains part of the prediction bias. The evidence suggests that mood can explain part of the error in inflation and output growth predictions, and hence, that anomalies should be taken into account when trying to understand expectation formation and assess the uncertainty related to private forecasters’ point predictions.

Journal Title: International Journal of Forecasting

Year Published: 2019

Link to full text (if available)

Share on Social Media: Sign Up to like & get

recommendations!