Photo from wikipedia

Abstract Financial institutions' roles in sustainable development have been a hot topic in the literature. Nonetheless, related studies are still emerging and are rare for emerging markets. The purpose of… Click to show full abstract

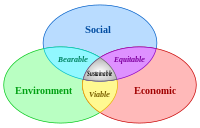

Abstract Financial institutions' roles in sustainable development have been a hot topic in the literature. Nonetheless, related studies are still emerging and are rare for emerging markets. The purpose of this paper is to investigate multidimensional corporate sustainability practices and establish a corporate sustainability performance evaluation model for Turkish banks. According to the multiple dimensions of economic, environmental, and social governance and financial corporate sustainability, the Content Analysis and TOPSIS methods are utilized on the 12 sustainability reports published by four Turkish deposit banks from 2012 to 2014. The TOPSIS method has been employed for the comprehensive assessment by using the entropy weights of Turkish Banking Sector sustainability practices in order to overcome subjectivity. One of the significant contributions of this study is the combined use of the results of content analysis, entropy weights and TOPSIS. The performance scores for the dimensional base reveals that each bank has different performance scores in each year. Additionally, rather than having the highest score in one or more dimensions, improving performance in all dimensions provides a substantial contribution to the bank's overall score and ranking.

Journal Title: Journal of Cleaner Production

Year Published: 2018

Link to full text (if available)

Share on Social Media: Sign Up to like & get

recommendations!