Photo from wikipedia

Abstract We simulate the impact on the nonbank liabilities of banks in a multiplex interbank environment arising from changes in currency exposure. Currency shocks as a source of financial contagion… Click to show full abstract

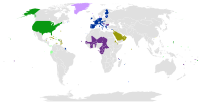

Abstract We simulate the impact on the nonbank liabilities of banks in a multiplex interbank environment arising from changes in currency exposure. Currency shocks as a source of financial contagion in the banking sector have not, so far, been considered. Our model considers two sources of contagion: shocks to nonbank assets and exchange rate shocks. Interbank loans can mature at different times. We demonstrate that a dominant currency can be a significant source of financial contagion. We also find evidence of asymmetries in losses stemming from large currency depreciations versus appreciations. A variety of scenarios are considered allowing for differences in the sparsity of the banking network, the relative size and number of banks, changes in nonbank assets and equity, the possibility of bank breakups, and the dominance of a particular currency. Policy implications are also drawn.

Journal Title: Journal of Financial Stability

Year Published: 2021

Link to full text (if available)

Share on Social Media: Sign Up to like & get

recommendations!