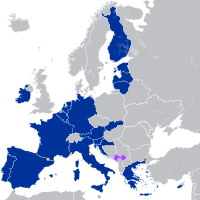

Photo from wikipedia

I analyze spillover effects from a Euro area monetary policy shock to fourteen European countries outside the Euro area. The analysis is based on a factor-augmented VAR model with two… Click to show full abstract

I analyze spillover effects from a Euro area monetary policy shock to fourteen European countries outside the Euro area. The analysis is based on a factor-augmented VAR model with two blocks, which exploits a large cross-country data set. After a Euro area monetary policy expansion, production increases in most non-Euro area countries, whereas short-term interest rates and financial uncertainty decline. These effects are on average comparable to the responses in the aggregate Euro area. However, the size of spillover effects varies with country characteristics. Spillovers on production are larger in non-Euro area economies with higher trade openness, whereas financial variables react to a higher extent in countries with higher financial integration. Regarding the exchange rate regime, countries with fixed exchange rates show stronger spillovers both in terms of production and interest rates. Finally, prices increase in Western European economies outside the Euro area, but decline or do not respond in Central and Eastern Europe.

Journal Title: Journal of International Money and Finance

Year Published: 2017

Link to full text (if available)

Share on Social Media: Sign Up to like & get

recommendations!