Photo from wikipedia

ABSTRACT Since April 2014 to March 2015, the European Central Bank expansionary monetary policy instigates a huge depreciation of the euro in terms of dollar. According to the mainstream monetary… Click to show full abstract

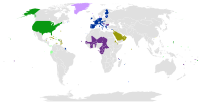

ABSTRACT Since April 2014 to March 2015, the European Central Bank expansionary monetary policy instigates a huge depreciation of the euro in terms of dollar. According to the mainstream monetary theory, these dynamics should make the exports cheaper and at the same time make the imports more expensive. Has real depreciation of the euro helped in the improvement of European countries’ trade balances? Following the main methodologies in the recent literature, our study analyses the effects of this depreciation both for Italy and Germany towards the US. We use industry-level data at monthly frequency. The results are different from each bilateral relationship. We find that 11 industries register a long-run improvement (8 for Italy and 3 for Germany). The J-curve effect is proven just in six cases, always for Italy. The inverted J-curve effect is proven in eight cases, four for Germany, and four for Italy. These results seem to be an indirect demonstration of the structural asymmetries between German and Italian economies: German economic system is more able to be competitive with a strong currency, than Italy.

Journal Title: Applied Economics

Year Published: 2018

Link to full text (if available)

Share on Social Media: Sign Up to like & get

recommendations!