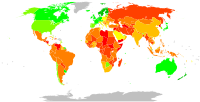

Photo from wikipedia

Purpose This paper aims to examine the association between political connections and tax evasion and test whether corruption level affects this relationship. Design/methodology/approach Tax evasion measure is based on Schneider… Click to show full abstract

Purpose This paper aims to examine the association between political connections and tax evasion and test whether corruption level affects this relationship. Design/methodology/approach Tax evasion measure is based on Schneider et al. (2010), while country’s political connection trend is based on Faccio (2006). Findings Using a sample of 35 countries, the authors document that political connections are positively associated with tax evasion and this relationship becomes stronger for high corrupt environment. Originality/value The findings have policy implications for countries aiming to combat tax evasion as political connection trends in one country reduce the level of tax compliance. In addition, political connections and corruption play a complimentary role in increasing tax evasion practices.

Journal Title: Journal of Financial Crime

Year Published: 2019

Link to full text (if available)

Share on Social Media: Sign Up to like & get

recommendations!