Photo from wikipedia

Investing in funds has the effect of indirectly employing asset management professionals with specialized knowledge and experience, which can result in a diversified investment through the use of a portfolio.… Click to show full abstract

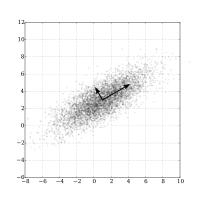

Investing in funds has the effect of indirectly employing asset management professionals with specialized knowledge and experience, which can result in a diversified investment through the use of a portfolio. In this study, we focus on learning the patterns of prices rather than time points to predict Korean fund prices. We convert time-series data into 2-dimensional images and analyze them using a convolutional neural network. To improve the fund price forecasting performance, we consider the following aspects. A Korean fund should be recommended according to the level of risk aversion. The risk level of the fund is determined by the proportion of risky assets. Therefore, when estimating the fund price, the risk level of the fund needs to be considered. In this study, we use 15 additional variables, such as foreign stock indexes, foreign exchange rates, and Korean stock indices, in addition to the fund price data. The appropriate filter size, which plays an important role in this process, is proposed. In addition, types of networks and architectures are selected as suitable for forecasting the fund price. We also demonstrate that the number of output classes can be adjusted to increase the future return of the fund. Through this methodology with multiple variables, we can achieve a 25% cumulative profit for 2 years. This means that multi-variable models have a higher cumulative return than the single-variable model and KOSPI and thus a higher average of all funds for active investors.

Journal Title: IEEE Access

Year Published: 2019

Link to full text (if available)

Share on Social Media: Sign Up to like & get

recommendations!