Photo from wikipedia

Background and objective Numerous studies have indicated that tobacco taxation is one of the most important policies to reduce tobacco consumption. However, its effectiveness crucially depends on consumer responses to… Click to show full abstract

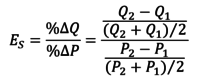

Background and objective Numerous studies have indicated that tobacco taxation is one of the most important policies to reduce tobacco consumption. However, its effectiveness crucially depends on consumer responses to price increases, that is, tobacco price elasticities. This paper analyses tobacco price elasticity in six Western Balkan countries. Data and methods We estimate own-price and cross-price elasticities of manufactured cigarettes (MCs) and roll-your-own (RYO) tobacco by using the methodological framework of the two-part model, regional variation in prices and 2019 Survey on Tobacco Consumption in Southeastern European countries (STC-SEE). STC-SEE provides a uniquely comparable nationally representative data on smoking behaviour for adult (18–85 years old) population for each country. Results Results suggest that higher prices of MCs are associated with lower prevalence of MC use, while higher prices of RYO are associated with lower intensity of RYO use. Furthermore, regions with higher MC prices have a higher likelihood of using RYO over MC, suggesting that RYO is used as a cheaper alternative to MC. Lastly, lower smoking prevalence and intensity are associated with more smoking restrictions and support for tobacco price increases. Conclusion Results suggest that, aiming to decrease smoking prevalence and intensity, governments should increase excises on all tobacco products. Since RYO is a cheaper alternative to MC, the increase of excises on RYO should be higher, so that after excise increase, the prices of the two products are approximately the same. To further reduce tobacco consumption, governments should combine increasing taxes on tobacco products with non-price measures, such as stricter smoking restrictions and smoke-free regulations.

Journal Title: Tobacco Control

Year Published: 2022

Link to full text (if available)

Share on Social Media: Sign Up to like & get

recommendations!