Photo from wikipedia

This article evaluates whether changes in relative earnings across majors due to a federal tax reform are likely to affect college major choice. I first estimate the change in expected… Click to show full abstract

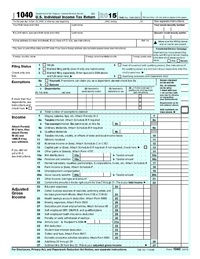

This article evaluates whether changes in relative earnings across majors due to a federal tax reform are likely to affect college major choice. I first estimate the change in expected after-tax lifetime income due to the 1986 Tax Reform Act for 47 majors. I find that the average major experienced an increase in expected after-tax lifetime income of 6.2 percent and that the standard deviation of major-specific expected lifetime income premia increased by 6.1 percent. I estimate the impact of the change in relative earnings on the distribution of completed college majors, finding no statistically significant change in the composition of majors following the reform. Consistent with the estimation, simulations reveal that at most 0.25 percent of males completed a different major in response to the reform.

Journal Title: Public Finance Review

Year Published: 2019

Link to full text (if available)

Share on Social Media: Sign Up to like & get

recommendations!