Photo from wikipedia

In this paper, we propose a comparison among three portfolio insurance strategies, namely the constant proportion portfolio insurance, the time-invariant portfolio protection, and the exponential proportion portfolio insurance, via an… Click to show full abstract

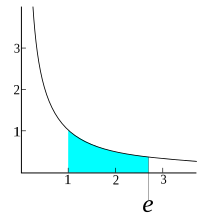

In this paper, we propose a comparison among three portfolio insurance strategies, namely the constant proportion portfolio insurance, the time-invariant portfolio protection, and the exponential proportion portfolio insurance, via an in-depth performance analysis. We aim to ascertain whether strategies characterized by variable parameters can outperform those with constant parameters by measuring potential returns, investment riskiness, downside protection capability, and ability to capture market upside. The results, achieved in a model-free framework by exploiting bootstrapping techniques, advise that no winning strategy exists overall, even when considering different volatility regimes, rebalancing frequencies, and protection levels.

Journal Title: Risks

Year Published: 2023

Link to full text (if available)

Share on Social Media: Sign Up to like & get

recommendations!