The Dynamic Volatility Connectedness Structure of Energy Futures and Global Financial Markets: Evidence From a Novel Time–Frequency Domain Approach

Sign Up to like & getrecommendations! Published in 2021 at "Computational Economics"

DOI: 10.1007/s10614-021-10120-x

Abstract: We consider directional volatility connectedness among energy markets and financial markets over time and frequencies simultaneously during the period 2007–2018. We utilize and expand Barunik and Krehlik (J Financ Econom 16:271-296, 2018) connectedness measurements using… read more here.

Keywords: time; financial markets; connectedness; volatility connectedness ... See more keywords

The good, the bad and the ugly relation between oil and commodities: An analysis of asymmetric volatility connectedness and portfolio implications

Sign Up to like & getrecommendations! Published in 2020 at "Energy Economics"

DOI: 10.1016/j.eneco.2020.105061

Abstract: Abstract This study examines the direction and extent of asymmetric volatility connectedness between the oil and commodity markets, using five-minute interval data from the oil, natural gas, and 21 commodity futures markets. We also analyze… read more here.

Keywords: volatility; good bad; asymmetric volatility; volatility connectedness ... See more keywords

Realised volatility connectedness among Bitcoin exchange markets

Sign Up to like & getrecommendations! Published in 2019 at "Finance Research Letters"

DOI: 10.1016/j.frl.2019.101391

Abstract: Abstract This paper examines the system of Bitcoin exchanges with respect to their common dynamics. We employ connectedness measures based on the daily realised volatility of Bitcoin prices, for which the results reveal that Coinbase… read more here.

Keywords: connectedness; connectedness among; volatility; among bitcoin ... See more keywords

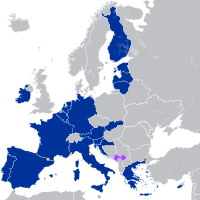

The Eurozone banking sector in the time of COVID-19: Measuring volatility connectedness

Sign Up to like & getrecommendations! Published in 2021 at "Global Finance Journal"

DOI: 10.1016/j.gfj.2021.100677

Abstract: Abstract This article investigates the volatility connectedness of the Eurozone banking system over the last 15 years (from 2005 to 2020). Applying the Diebold-Yilmaz Connectedness Index model to the daily stock return volatilities of 30… read more here.

Keywords: eurozone; banking; eurozone banking; volatility connectedness ... See more keywords

On the Dynamics of International Real-Estate-Investment Trust-Propagation Mechanisms: Evidence from Time-Varying Return and Volatility Connectedness Measures

Sign Up to like & getrecommendations! Published in 2021 at "Entropy"

DOI: 10.3390/e23081048

Abstract: In this paper, we investigate the time-varying interconnectedness of international Real Estate Investment Trusts (REITs) markets using daily REIT prices in twelve major REIT countries since the Global Financial Crisis. We construct dynamic total, net… read more here.

Keywords: international real; return volatility; estate investment; real estate ... See more keywords

Volatility Connectedness between Clean Energy Firms and Crude Oil in the COVID-19 Era

Sign Up to like & getrecommendations! Published in 2020 at "Sustainability"

DOI: 10.3390/su12239863

Abstract: The work investigates the volatility connectedness between oil price and clean energy firms over the period 2011–2020 (including the COVID-19 outbreak). Using the volatility spillover models, and dynamic conditional correlation, we are able to identify… read more here.

Keywords: volatility; covid; volatility connectedness; clean energy ... See more keywords